Welcome to ProCredit Direct – your online banking platform

Are you a modern professional with a busy schedule, or a depositor looking for a secure way to save? Would you like to make your banking transactions whenever and wherever you like, easily and securely?

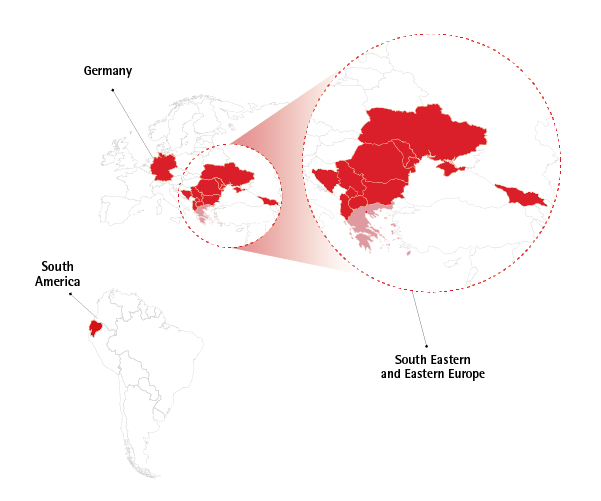

If so, ProCredit Bank, the first German bank in Eastern Europe, now offers ProCredit Direct, a digital platform providing not only direct 24-hour access to all the banking services you need to manage your funds, but also full control over your finances.

Everything you need from a bank

Our current account provides you with around-the-clock access to all the services you need:

- Money transfers, utility payments, standing orders, contactless debit card, SMS notifications for all transactions, cash withdrawals at ATMs

- FlexSave savings account with maximum flexibility

- Term deposits to accommodate long-term planning

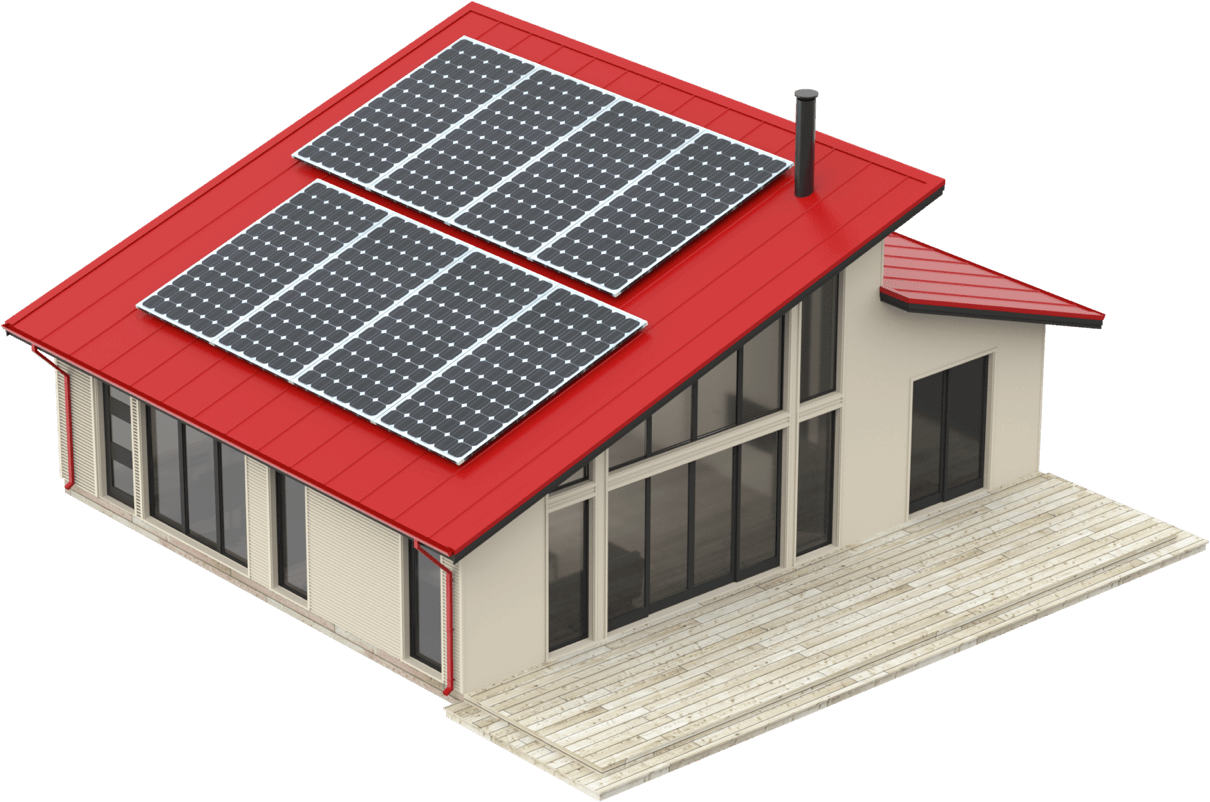

- FlexFund, investment loans, and housing loans

No more waiting in line. You can do your banking wherever and whenever you like.

All for one flat fee!

Anytime and anywhere

Manage your finances conveniently and securely via our 24/7 service channels.

If you have any questions, please refer to the FAQ section at the end of this page or get in touch with our contact centre.

ProCredit is:

- A development-oriented group of commercial banks operating as a responsible Hausbank for SMEs and a DIRECT bank for private clients

- A German group headquartered in Frankfurt and supervised by both the German Financial Supervisory Authorities at group level and the respective regulatory body in each country

- Profitable and stable at group level with no speculative lines of business

- Listed in the Prime Standard segment on the Frankfurt Stock Exchange under ProCredit Holding, the parent company (for more information click here)

We focus on your needs and on the quality of our services

- We invest in the local economy by supporting SMEs

- We care about the environment

- We do not believe in bonuses but rather in staff development

- We invest in modern technology and in our digital channels

- We take data security seriously and comply with European standards

Our group-wide policies and standards and our strict exclusion list support the healthy growth of our loan portfolio and the establishment of long-term relationships with our customers.